European industrial real estate investment pauses in Q1 2012

Industrial transaction volumes reached €1.5 billion, held down by limited prime opportunities despite continued appetite, according to Jones Lang LaSalle research

The majority of European industrial investment markets recorded a quiet start to the year following a flurry of activity in the final quarter of 2011.

Notable exceptions were Germany and Poland with the sales of two logistics portfolios sold by Prologis and comprising six properties and two logistics parks in Germany and four properties in Poland, boosting results in the two markets. As a result, volumes rose 12% on the equivalent quarter last year in Germany while they rose by 37% in Poland in the same comparison.

Across Europe, total volumes invested in industrial assets in Q1 2012 reached €1.5 billion, down 40% on the same period last year while dropping to less than half if compared with the buoyant final quarter of 2011. Jones Lang LaSalle advised on approximately 30% of the total volume transacted in Q1 2012. Notable transactions included the sale of the Prologis portfolio in Germany (€138 million), the sale of the Polish Prologis portfolio (€100 million), the purchase of a distribution warehouse in Werl, Germany on behalf of Rockspring (€17 million), the sale of the La Poste distribution unit in Lyon, France (€22 million)as well as the Iceland Distribution Centre in Enfield, Greater London (€42 million).

“Falling activity was the result of a lack of prime investment opportunities and sustained economic pressures continuing to restrict the availability of debt finance” comments Penny Hacking, Director, Jones Lang LaSalle European Logistics and Industrial Capital Markets. “On a positive note we continue to see increasing demand from a growing range of investors. Therefore we expect full year 2012 industrial transaction volumes to remain consistent with 2011” she adds.

The UK, Germany and France continued to be the most traded markets, accounting for almost €1.2 billion, nearly 80% of the European total. Contrary to increased volumes in Germany, in comparison to the same quarter in 2011, volumes fell by 16% in the UK to €715 million and by almost 50% in France to €115 million. In Germany, €350 million was invested in Q1 2012. The strong quarter result was helped by the sale of a logistics portfolio, accounting for around 40% of total volumes.

The strongest annual growth was recorded in Poland, where around €100 million was invested in Q1 2012, almost 40% more than during the first quarter in 2011, driven by the sale of a logistics portfolio.

However, following a strong 2011, investment in industrial assets slowed sharply across the whole CEE region as well as in Russia in Q1 2012 with Poland so far the only country recording transaction activity.

“Prime opportunities in CEE and Russia continue to be limited. Following strong investment activity last year, only a small number of international-style industrial assets remain on the market. As a result, in the full year 2012 we expect to see weaker investment volumes within the region although investors continue to look intensively for opportunities to maximise positive yield gaps and positive market fundamentals” said Penny Hacking.

Elsewhere, industrial investment activity remained subdued across all markets. Volumes were down by 85% year-on-year in the Benelux and 72% in the Nordics, with no significant activity recorded outside of Sweden. Helped by a 7% increase in Italy based on very low volumes, the Southern Periphery (Italy, Portugal and Spain) saw a slightly softer decline in total transactions, down 53%.

Cross border transactions declined to 52% in Q1 2012, down from 65% in 2011 overall. Nevertheless, with around €500 million, international money remained the strongest source, accounting for one third of the total, closely followed by UK investors.

“The slowing volume of cross border transactions were driven by a combination of risk aversion, limited prime institutional product on the market and tight debt finance. As a result, investors are examining opportunities more closely before taking decisions and in particular international money is currently focused on the more liquid core markets perceived to be less risky’” notes Alexandra Tornow, responsible for EMEA Logistics and Industrial Research at Jones Lang LaSalle.

During the first three months of 2012, internationally sourced capital was invested in only four countries: the three core markets UK, Germany and France, and Poland. With 43% of the total, the UK reached the highest share, followed by Germany (34%), Poland (21%) while only a marginal 2% was invested in France. Further cross border deals in Q1 2012 based on money from a single European country were seen in the same four markets as well as in the Netherlands and Sweden.

Limited prime opportunities meant that investor competition for core assets let to strong covenants remained strong during Q1 2012 despite slowing volumes. As a result, yield levels remained stable across all major markets while few smaller regional markets saw marginal corrections over the quarter (Utrecht: -10bps; St. Petersburg: – 50bps; Lisbon: 25bps; Valencia: 50bps; Leeds: 50bps). Consequently, the weighted European net initial prime yield was unchanged for the fourth consecutive quarter in Q1 2012 at 7.40%.

“We expect to see a greater diversification in yield movements over the next few quarters while overall in 2012 the weighted European prime yield is likely to stabilise as ongoing compression across German markets will be outweighed by yields moving out slightly across some non-core markets. With rental growth prospects slowing, capital value growth in 2012 is therefore expected to be slightly negative in the Europe aggregate, with pockets of growth remaining only in a restricted number of markets, notably Germany and Russia” adds Alexandra Tornow.

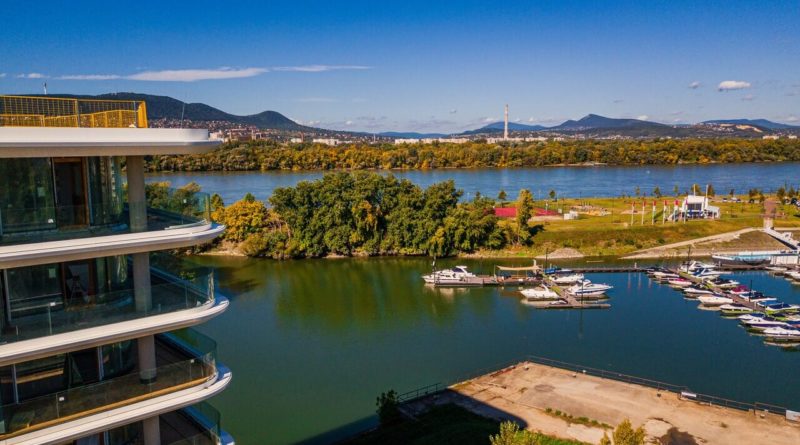

Benjamin Perez-Ellischewitz, Head of Capital Markets at Jones Lang LaSalleHungary added: “During the first quarter of 2012 no major real estate transaction was concluded in Hungary so the lack of liquidity is not limited to the logistic / industrial segment of the market. Some good quality logistic assets are for sale but so far the buyers’ and sellers’ price expectations did not match. The weighted average lease term profile is often perceived as too short by the investors and the very limited supply of bank finance makes it even more difficult to close transactions. That said, I hope that by year end we will see significant activity as more than €100 million of logistic and industrial assets are under exclusivity or marketing.”