European commercial real estate investment volumes at €25bn in Q3 2012

The European direct real estate investment market is holding up in line with expectations, according to the latest transaction data collected from Jones Lang LaSalle Capital Markets in 32 countries across Europe, Middle East and Africa.

· €25bn of direct commercial investment volumes recorded in Q3 2012 across Europe, Middle East and Africa (EMEA)

· Total for YTD 2012 reaches €75bn, only 12% below same period in 2011

· International capital continues to be attracted to core locations of London, Paris and Germany as investors shun riskier Southern Europe

· With supply of prime assets scarce, sectors such as residential and student accommodation are attracting more global investor appetite

· With a seasonally busy end to the year, fully year forecast remains at €108bn, 10% down on volumes recorded in 2011

Richard Bloxam, Head of European Capital Markets at Jones Lang LaSalles said:

“In Europe, as in other regions, the largest, most liquid markets continue to perform well. This is a reflection of the dominance of equity buyers who are currently looking for safe havens, and has to some extent offset a lack of transaction activity elsewhere in Europe.”

Robert Stassen, Head of European Capital Markets Research said:

“In the UK, London continues to dominate with robust levels of activity despite the Olympics which meant August was very quiet. Paris has had another strong quarter, as it continues to attract large inflows of international capital. Over the year to date, the UK and France have achieved volumes in line with the equivalent period last year, and together accounted for 50% of activity in Europe. In contrast, the lack of good quality stock on the market in the office and retail sectors in Germany has constrained commercial real estate volumes. However, there has been strong interest over the first three quarters of 2012 in the German residential sector which saw circa €8bn transacted compared to circa €6bn in the full year 2011. Looking at Central and Eastern Europe (including Russia) volumes have been subdued, down 40% on the equivalent period last year reflecting fewer investment opportunities rather than a change of investor sentiment.”

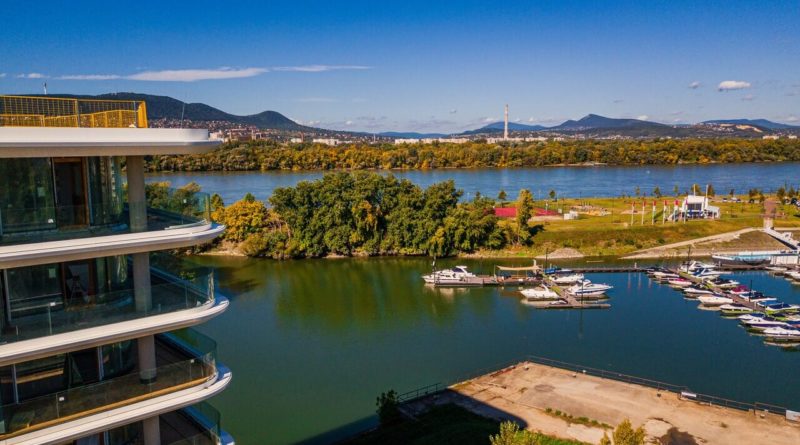

Marcell Szotyori-Nagy, Senior Investment Analystat Jones Lang LaSalle Budapest’s Capital Markets team added: “The total Hungarian real estate investment volume at the end of Q3 2012 stood at €75 million representing roughly an 80% decrease compared to last year’s volume. The most significant transaction so far in 2012 was the acquisition of the five star Le Meridien hotel by the Dubai based Al Habtoor Group. Although the closings of some significant transactions are anticipated by the end of the year the total volume will most probably not break the €150 million mark.”